Medicare Enrollment Options

For Local, Trusted, and Unbiased Medicare Enrollment Advise.

Call us at 888-564-2326

For Local, Trusted, and Unbiased Medicare Enrollment Advise.

Call us at 888-564-2326

Medicare was established in 1965 as a Federal health insurance program that covers seniors 65 and older and individuals under age 65 with certain disabling conditions.

If You:

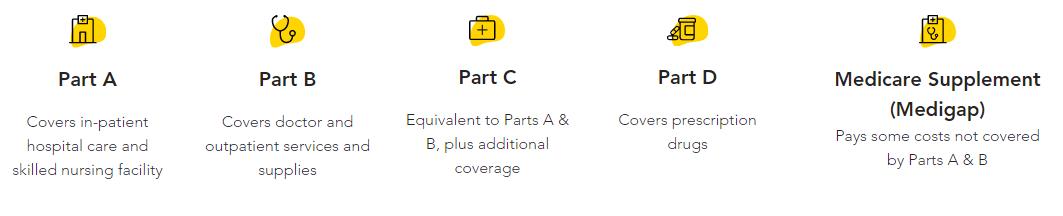

Hospital Coverage

Medical Insurance for Doctor visits and much more

Medicare Advantage Plans

These plans can also can include Prescription drug coverage and additional benefits not covered by Original Medicare.

Learn more about our Medicare Advantage plans.

Can be purchased as a stand alone plan or with Medicare Advantage Plan.

Everyone covered by Medicare Part A and , or B is eligible for Part D coverage, regardless of income and resources, or pre-existing conditions.

Learn more about our Medicare Prescription Drug Coverage PDP

The benefits provided and premium amounts depend on the plan you choose, your age, tobacco use and county of primary residence.

With our Medicare Supplement plans, we offer savings options, automatic claims filing and a 30-day money-back guarantee.

Call 888-564-2326

Nisona serves the insurance needs of the Treasure and Space Coast.